Powerful Solutions

A much better way to

balance your portfolio

Are traditional financial strategies enough?

Explore a fresh approach that combines

investment growth with unparalleled security.

Your’e doing what everyone had to told you to do to achieve financial independence.

Maxing out your 401k, paying off your mortgage early, and keeping a large amount of cash on-hand just in case you need some before retirement. Yet you have a nagging question in the back of your mind: is all this really going to work? Is it going to allow me to maintain my standard of living in retirement? Maybe it won’t even allow me to ever retire?

And you already know what most advisors recommend: creating what is called a “balanced portfolio”, which is mostly a mix of equities and fixed income assets, with differing percentages of given asset classes, such as US large cap companies.

We look at your portfolio in a unique way.

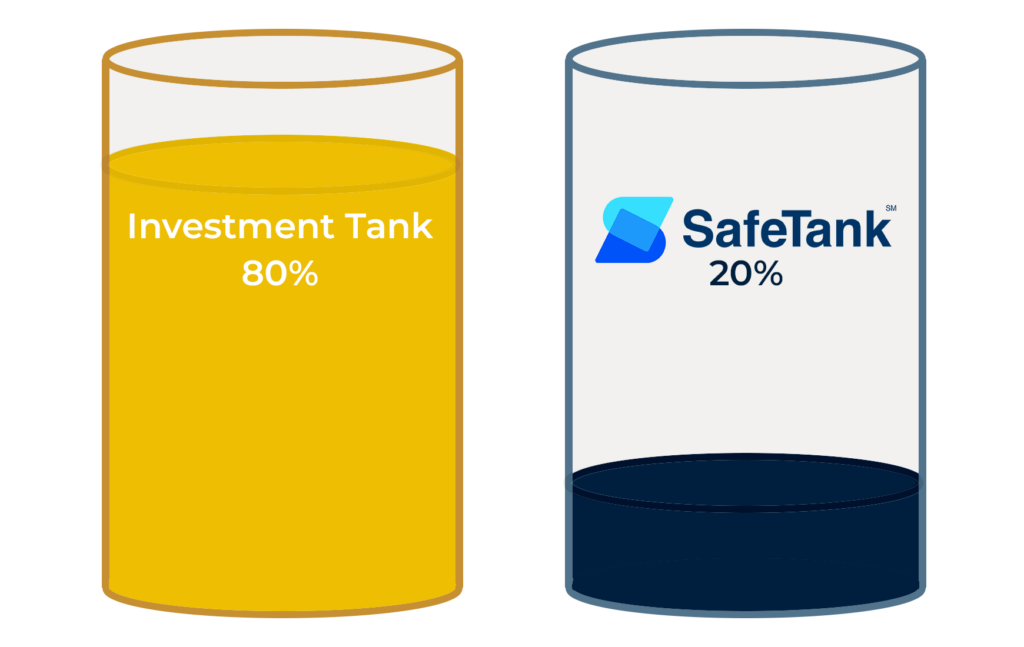

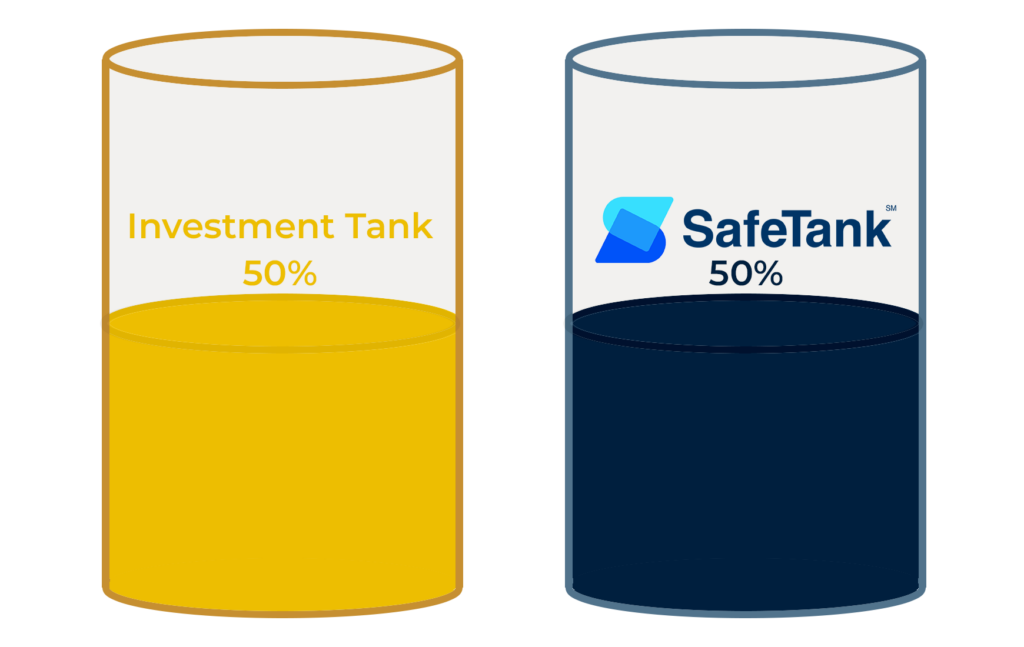

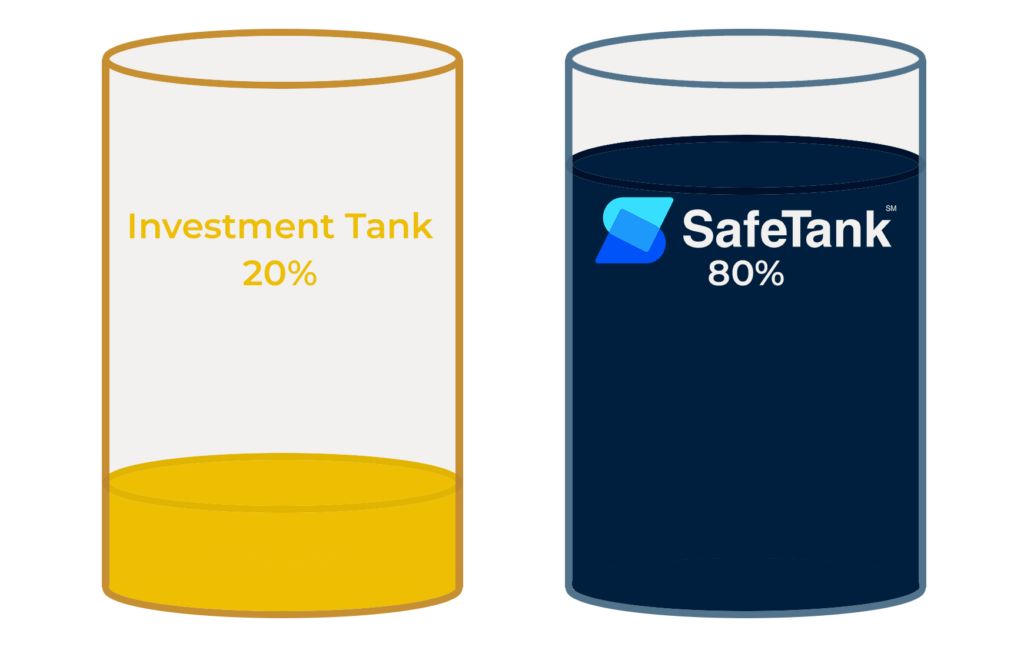

When working with us, we help you create a portfolio in two separate but interconnected tanks, if you will. An investment tank, of mostly equities with various asset classes and a SafeTank℠ (from Gondola). SafeTank℠ replaces the need for fixed income because it is safe (with a 0% or 1% floor and unlimited upside potential), tax free (tax free use of your money) and accessible (usually within three business days).

To get started, we recommend speaking to an advisor who, through a series of important questions, will discover your goals, priorities & experiences with creating wealth for you and your family. The advisor will then give you some insight into how our unique two-tank approach could strengthen your strategy. Essentially, once you know what your options are, we begin adjusting your portfolio to make it synch with your goals and personality.

For some, this means one of the following:

Either way, we can model any of your potential choices with our software so that you can see the effect before making your decision. A sort of see-before-you-buy approach.

If this sounds like a fresh and reasonable approach, here’s how you may request a meeting with us….

Partners

Brian S. Dumont, EdM

Founder, CEO of Dumont Wealth

Brian S. Dumont, EdM, is the Founder and CEO of Dumont Wealth, and has been in financial services since 2004. It is his passion to teach his clients how their money works and what their options are so that together they can construct an effective, highly customized financial strategy for themselves and their families.

Brian comes from a college background in both the liberal arts (B.A., Psychology, Saint Anselm College), and the teaching arts (Ed.M., Master in Education, Boston University). As a result, his approach to working with families is both from the psychological, “how to help us make better financial decisions” and the educational, “here’s how all the pieces of your economic life work together”. In short, Brian’s style is a little like educational therapy for your money.

One of Brian’s core beliefs about money is that clients have more to gain by preventing losses than by simply trying to chase the highest rate of return. This is a very conservative approach to wealth management that helps families build a foundation for their financial future. At the same time, it positions them with the ability to capitalize on opportunities as they come about.

Brian is a Circle of Wealth Master Mentor, which is a niche within the financial planning world that operates from the assumption that putting clients in control of their money is a central strategy for financial success. He is also a financial and estate planner, wealth advisor, wealth transfer specialist, college planner and resident of New York City. He is licensed in New York, New Jersey, Connecticut, Massachusetts, Maine, Florida, Maryland and Texas for securities, life, accident and health. Currently, he is the private financial and estate planner for a highly select group of approximately fifty families.

Kevin M. Dumont, B.S.

CIO, Wealth Transfer Manager

Kevin M. Dumont, B.S. is the CIO and Wealth Transfer Manager at Dumont Wealth, and has worked in financial services since 2006, with the exception of a brief period in real estate from 2013-2015. Kevin shows a keen interest in helping others realize their potential for financial success through dedication to managing risk effectively. Kevin has a background in the liberal arts (Bachelor of Science, University of New England), as well as in the management of a small business (Window World), and 25 years of study as a 2nd Degree Black Belt in Tae Kwon Do.

As a Circle Of Wealth Advisor, Kevin teaches his clients about alternative ways to pay for major capital purchases using the Private Reserve method. He also helps clients understand the discipline and technical expertise it takes when developing a successful protection program. Known by clients for his value-centered solutions to their particular needs, Kevin focuses his energy on creative use of insurance from both a living and death benefit perspective. Currently a full time resident of Harrison, NJ, Kevin is a two-time winner of MetLife’s Best Agent award for excellence in service to clients. He is licensed in New York and New Jersey for life, accident and health insurance.

FAQ

What does the initial consultation involve?

The purpose of the initial consultation is typically twofold: first, to talk about your current situation, including your goals and beliefs; second, to talk about what we believe and how we work. At the conclusion of this, you and your advisor can usually decide if there is a match and if further consultations are worthwhile.

What is the cost of the initial consultation?

Generally, there is no fee charged for the initial consultation, unless specifically agreed to beforehand by both the advisor and client. In short, there is no obligation at the initial consultation, as it is intended as an exchange of information between advisor and client.

What do I need to bring to the initial consultation?

At the initial consultation, no documentation is required, as generally speaking, work on your “numbers” will not begin until the second meeting, unless agreed to beforehand by the advisor and client. If, however, you would like to have documents available for your reference (not for the advisor to collect), a list of documents can be found on the LAST page of the Dumont Wealth Confidential Questionnaire. Also, if at making the appointment it is decided that you will likely begin looking at your numbers, the advisor will forward the Dumont Wealth Confidential Questionnaire to you with instructions on what is required.

How can I make, change or cancel a meeting?

It is suggested that to make an initial appointment, please call Dumont Financial directly. By calling, you and an advisor will be able to clarify expectations and discuss potential dates. Once a time is chosen, an email confirmation and/or Calendar invitation will be sent. Please “Accept” the meeting so it is officially confirmed on both calendars. To change or cancel, please use the Calendar invitation. Our policy is a 48 hour change/cancellation notice (except for emergencies) to give you and the advisor time to reschedule. Thanks for your assistance with this policy.

Is there a list of Dumont Wealth clients with whom I could speak?

If you are looking for firsthand experience from a Dumont Wealth client on how we have helped them achieve financial peace of mind through comprehensive planning and full disclosure, please request a referral from your advisor. Referrals are available on an individual requested basis.

Where is the office located?

The main office is located at the famous Rockefeller Plaza. You can enter the side of building 1, directly across from NBC’s Today Show. Please bring a picture ID with you for the security desk.

What safeguards are in place at Dumont Wealth to protect my investments from Madoff-type and other scams?

First, Dumont Wealth uses only registered investment products. This means that third party regulatory agencies (SEC, SIPC and the MSRB) supervise all products where your money is placed through Dumont Wealth. In addition, Efficient Wealth Partners is an Securities and Exchange Commission (SEC) registered firm. For more information on how the SEC, SIPC and the MSRB protects you as an investor, please see their websites.

How can I view my account online?

Because Dumont Wealth works with a number of third party money managers and financial product providers, please contact your advisor directly for specific instructions on setting up your account(s) for viewing. Insurance accounts including life, disability, long term care and health – some carriers allow you to view your account live. Many do not. Please contact your advisor for your specific policy viewing options.